Financial Markets: Role in the Economy, Importance, Types, and Examples

Financial Markets: Role in the Economy, Importance, Types, and Examples

Investing

Stocks

Cryptocurrency

Bonds

ETFs

Options and Derivatives

Commodities

Trading

Automated Investing

Brokers

Fundamental Analysis

Markets

View All

Simulator

Login / Portfolio

Trade

Research

My Games

Leaderboard

Banking

Savings Accounts

Certificates of Deposit (CDs)

Money Market Accounts

Checking Accounts

View All

Personal Finance

Budgeting and Saving

Personal Loans

Insurance

Mortgages

Credit and Debt

Student Loans

Taxes

Credit Cards

Financial Literacy

Retirement

View All

News

Markets

Companies

Earnings

CD Rates

Mortgage Rates

Economy

Government

Crypto

ETFs

Personal Finance

View All

Reviews

Best Online Brokers

Best Savings Rates

Best CD Rates

Best Life Insurance

Best Personal Loans

Best Mortgage Rates

Best Money Market Accounts

Best Auto Loan Rates

Best Credit Repair Companies

Best Credit Cards

View All

Academy

Investing for Beginners

Trading for Beginners

Become a Day Trader

Technical Analysis

All Investing Courses

All Trading Courses

View All

Live

Search

Search

Please fill out this field.

Search

Search

Please fill out this field.

Investing

Investing

Stocks

Cryptocurrency

Bonds

ETFs

Options and Derivatives

Commodities

Trading

Automated Investing

Brokers

Fundamental Analysis

Markets

View All

Simulator

Simulator

Login / Portfolio

Trade

Research

My Games

Leaderboard

Banking

Banking

Savings Accounts

Certificates of Deposit (CDs)

Money Market Accounts

Checking Accounts

View All

Personal Finance

Personal Finance

Budgeting and Saving

Personal Loans

Insurance

Mortgages

Credit and Debt

Student Loans

Taxes

Credit Cards

Financial Literacy

Retirement

View All

News

News

Markets

Companies

Earnings

CD Rates

Mortgage Rates

Economy

Government

Crypto

ETFs

Personal Finance

View All

Reviews

Reviews

Best Online Brokers

Best Savings Rates

Best CD Rates

Best Life Insurance

Best Personal Loans

Best Mortgage Rates

Best Money Market Accounts

Best Auto Loan Rates

Best Credit Repair Companies

Best Credit Cards

View All

Academy

Academy

Investing for Beginners

Trading for Beginners

Become a Day Trader

Technical Analysis

All Investing Courses

All Trading Courses

View All

Economy

Economy

Government and Policy

Monetary Policy

Fiscal Policy

Economics

View All

Financial Terms

Newsletter

About Us

Follow Us

Table of Contents

Expand

Table of Contents

What Are Financial Markets?

Understanding Financial Markets

Types of Financial Markets

Examples of Financial Markets

FAQs

The Bottom Line

Investing

Markets

Financial Markets: Role in the Economy, Importance, Types, and Examples

By

Adam Hayes

Full Bio

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Learn about our

editorial policies

Updated October 24, 2023

Reviewed by

Cierra Murry

Reviewed by

Cierra Murry

Full Bio

Cierra Murry is an expert in banking, credit cards, investing, loans, mortgages, and real estate. She is a banking consultant, loan signing agent, and arbitrator with more than 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

Learn about our

Financial Review Board

Fact checked by

Kirsten Rohrs Schmitt

What Are Financial Markets?

Financial markets refer broadly to any marketplace where securities trading occurs, including the stock market, bond market, forex market, and derivatives market. Financial markets are vital to the smooth operation of capitalist economies.

Key Takeaways

Financial markets refer broadly to any marketplace where the trading of securities occurs.There are many kinds of financial markets, including (but not limited to) forex, money, stock, and bond markets.These markets may include assets or securities that are either listed on regulated exchanges or trade over-the-counter (OTC).Financial markets trade in all types of securities and are critical to the smooth operation of a capitalist society.When financial markets fail, economic disruption, including recession and rising unemployment, can result.

Investopedia / Theresa Chiechi

Understanding the Financial Markets

Financial markets play a vital role in facilitating the smooth operation of capitalist economies by allocating resources and creating liquidity for businesses and entrepreneurs. The markets make it easy for buyers and sellers to trade their financial holdings. Financial markets create securities products that provide a return for those with excess funds (investors/lenders) and make these funds available to those needing additional money (borrowers).

The stock market is just one type of financial market. Financial markets are created when people buy and sell financial instruments, including equities, bonds, currencies, and derivatives. Financial markets rely heavily on informational transparency to ensure that the markets set prices that are efficient and appropriate.

Some financial markets are small with little activity, and others, like the New York Stock Exchange (NYSE), trade trillions of dollars in securities daily. The equities (stock) market is a financial market that enables investors to buy and sell shares of publicly traded companies. The primary stock market is where new issues of stocks are sold. Any subsequent trading of stocks occurs in the secondary market, where investors buy and sell securities they already own.

Prices of securities traded in the financial markets may not necessarily reflect their intrinsic value.

Types of Financial Markets

There are several different types of markets. Each one focuses on the types and classes of instruments available on it.

Stock Markets

Perhaps the most ubiquitous of financial markets are stock markets. These are venues where companies list their shares, which are bought and sold by traders and investors. Stock markets, or equities markets, are used by companies to raise capital and by investors to search for returns.

Stocks may be traded on listed exchanges, such as the New York Stock Exchange (NYSE), Nasdaq, or the over-the-counter (OTC) market. Most stock trading is done via regulated exchanges, which plays an important economic role because it is another way for money to flow through the economy.

Typical participants in a stock market include (both retail and institutional) investors, traders, market makers (MMs), and specialists who maintain liquidity and provide two-sided markets. Brokers are third parties that facilitate trades between buyers and sellers but who do not take an actual position in a stock.

Over-the-Counter Markets

An over-the-counter (OTC) market is a decentralized market—meaning it does not have physical locations, and trading is conducted electronically—in which market participants trade securities directly (meaning without a broker). While OTC markets may handle trading in certain stocks (e.g., smaller or riskier companies that do not meet the listing criteria of exchanges), most stock trading is done via exchanges. Certain derivatives markets, however, are exclusively OTC, making up an essential segment of the financial markets. Broadly speaking, OTC markets and the transactions that occur in them are far less regulated, less liquid, and more opaque.

Bond Markets

A bond is a security in which an investor loans money for a defined period at a pre-established interest rate. You may think of a bond as an agreement between the lender and borrower containing the loan's details and its payments. Bonds are issued by corporations as well as by municipalities, states, and sovereign governments to finance projects and operations. For example, the bond market sells securities such as notes and bills issued by the United States Treasury. The bond market is also called the debt, credit, or fixed-income market.

Money Markets

Typically, the money markets trade in products with highly liquid short-term maturities (less than one year) and are characterized by a high degree of safety and a relatively lower interest return than other markets.

At the wholesale level, the money markets involve large-volume trades between institutions and traders. At the retail level, they include money market mutual funds bought by individual investors and money market accounts opened by bank customers. Individuals may also invest in the money markets by purchasing short-term certificates of deposit (CDs), municipal notes, or U.S. Treasury bills, among other examples.

Derivatives Markets

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index). Rather than trading stocks directly, a derivatives market trades in futures and options contracts and other advanced financial products that derive their value from underlying instruments like bonds, commodities, currencies, interest rates, market indexes, and stocks.

Futures markets are where futures contracts are listed and traded. Unlike forwards, which trade OTC, futures markets utilize standardized contract specifications, are well-regulated, and use clearinghouses to settle and confirm trades. Options markets, such as the Chicago Board Options Exchange (Cboe), similarly list and regulate options contracts. Both futures and options exchanges may list contracts on various asset classes, such as equities, fixed-income securities, commodities, and so on.

Forex Market

The forex (foreign exchange) market is where participants can buy, sell, hedge, and speculate on the exchange rates between currency pairs. The forex market is the most liquid market in the world, as cash is the most liquid of assets. The currency market handles more than $7.5 trillion in daily transactions, more than the futures and equity markets combined.

As with the OTC markets, the forex market is also decentralized and consists of a global network of computers and brokers worldwide. The forex market is made up of banks, commercial companies, central banks, investment management firms, hedge funds, and retail forex brokers and investors.

Commodities Markets

Commodities markets are venues where producers and consumers meet to exchange physical commodities such as agricultural products (e.g., corn, livestock, soybeans), energy products (oil, gas, carbon credits), precious metals (gold, silver, platinum), or "soft" commodities (such as cotton, coffee, and sugar). These are known as spot commodity markets, where physical goods are exchanged for money.

However, the bulk of trading in these commodities takes place on derivatives markets that utilize spot commodities as the underlying assets. Forwards, futures, and options on commodities are exchanged both OTC and on listed exchanges around the world, such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

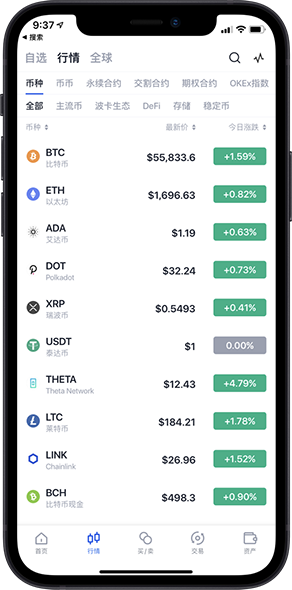

Cryptocurrency Markets

Thousands of cryptocurrency tokens are available and traded globally across a patchwork of independent online crypto exchanges. These exchanges host digital wallets for traders to swap one cryptocurrency for another or for fiat monies such as dollars or euros.

Because most crypto exchanges are centralized platforms, users are susceptible to hacks or fraudulent activity. Decentralized exchanges are also available that operate without any central authority. These exchanges allow direct peer-to-peer (P2P) trading without an actual exchange authority to facilitate the transactions. Futures and options trading are also available on major cryptocurrencies.

Examples of Financial Markets

The above sections make clear that the "financial markets" are broad in scope and scale. To give two more concrete examples, we will consider the role of stock markets in bringing a company to IPO and the role of the OTC derivatives market in the 2008-09 financial crisis.

Stock Markets and IPOs

As a company establishes itself over time and grows, it needs access to additional capital. It will often find itself in need of much larger amounts of capital than it can get from ongoing operations, traditional bank loans, or venture and angel funding. Firms can raise the amount of capital they need by selling shares of itself to the public through an initial public offering (IPO). This changes the company's status from a "private" firm whose shares are held by a few shareholders to a publicly traded company whose shares will be subsequently held by public investors.

The IPO also offers early investors in the company an opportunity to cash out part of their stake, often reaping very handsome rewards in the process. Initially, the underwriters usually set the IPO price through their pre-marketing process.

Once the company's shares are listed on a stock exchange, and trading commences, the price of these shares will fluctuate as investors and traders assess and reassess their intrinsic value and the supply and demand for those shares at any given moment.

OTC Derivatives and the 2008 Financial Crisis: MBS and CDOs

While the 2008-09 financial crisis was caused and made worse by several factors, one factor that has been widely identified is the market for mortgage-backed securities (MBS). These are OTC derivatives where cash flows from individual mortgages are bundled, sliced up, and sold to investors. The crisis resulted from a sequence of events, each with its own trigger—these events culminated in the banking system's near-collapse. It has been argued that the seeds of the crisis were sown as far back as the 1970s with the Community Development Act, which required banks to loosen their credit requirements for lower-income consumers, creating a market for subprime mortgages.

The amount of subprime mortgage debt guaranteed by Freddie Mac and Fannie Mae continued to expand into the early 2000s when the Federal Reserve Board began to cut interest rates drastically to avoid a recession. The combination of loose credit requirements and cheap money spurred a housing boom, which drove speculation, pushing up housing prices and creating a real estate bubble. In the meantime, the investment banks, looking for easy profits in the wake of the dotcom bust and the 2001 recession, created a type of MBS called collateralized debt obligations (CDOs) from the mortgages purchased on the secondary market.

Because subprime mortgages were bundled with prime mortgages, there was no way for investors to understand the risks associated with the product. When the market for CDOs began to heat up, the housing bubble that had been building for several years finally burst. As housing prices fell, subprime borrowers began to default on loans that were worth more than their homes, accelerating the decline in prices.

When investors realized the MBS and CDOs were worthless due to the toxic debt they represented, they attempted to unload the obligations. However, there was no market for the CDOs. The subsequent cascade of subprime lender failures created liquidity contagion that reached the upper tiers of the banking system. Two major investment banks, Lehman Brothers and Bear Stearns, collapsed under the weight of their exposure to subprime debt, and more than 450 banks failed over the next five years. Several major banks were on the brink of failure and were rescued by a taxpayer-funded bailout.

What Are the Different Types of Financial Markets?

Some examples of financial markets and their roles include the stock market, the bond market, forex, commodities, and the real estate market, among others. Financial markets can also be broken down into capital markets, money markets, primary vs. secondary markets, and listed vs. OTC markets.

How Do Financial Markets Work?

Despite covering many different asset classes and having various structures and regulations, all financial markets work essentially by bringing together buyers and sellers in some asset or contract and allowing them to trade with one another. This is often done through an auction or price-discovery mechanism.

What Are the Main Functions of Financial Markets?

Financial markets exist for several reasons, but the most fundamental function is to allow for the efficient allocation of capital and assets in a financial economy. By allowing a free market for the flow of capital, financial obligations, and money, the financial markets make the global economy run more smoothly while allowing investors to participate in capital gains over time.

The Bottom Line

Financial markets provide liquidity, capital, and participation that are essential for economic growth and stability. Without financial markets, capital could not be allocated efficiently, and economic activity such as commerce and trade, investments, and growth opportunities would be greatly diminished.

Many players make markets an essential part of the economy—firms use stock and bond markets to raise capital from investors. Speculators look to various asset classes to make directional bets on future prices. At the same time, hedgers use derivatives markets to mitigate various risks, and arbitrageurs seek to take advantage of mispricings or anomalies observed across various markets. Brokers often act as mediators that bring buyers and sellers together, earning a commission or fee for their services.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our

editorial policy.

Compare Forex Brokers. "Forex Trading Statistics."

Federal Deposit Insurance Corporation. "Origins of the Crisis," Page 1-6.

Federal Reserve Bank of St. Louis. "Federal Funds Effective Rate (FEDFUNDS)."

Federal Deposit Insurance Corporation. "Bank Failures in Brief – Summary 2001 Through 2022."

Compare Accounts

Advertiser Disclosure

×

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Provider

Name

Description

Related Terms

Listed Security: What It Is and How It Works

A listed security is a financial instrument that is traded through an exchange, such as the NYSE or Nasdaq.

more

Overnight Trading: Definition, How It Works, and Example

Overnight trading refers to trades placed after an exchange’s close and before its open. It extends after-hours trading. Not all exchanges offer overnight trading.

more

OTC Pink: Definition, Company Types, Investment Risks

OTC Pink is the lowest tier of the three marketplaces for trading over-the-counter stocks provided and operated by the OTC Markets Group.

more

Non-Equity Option: What it is, How it Works

A non-equity option is a derivative contract with an underlying asset of instruments other than equities.

more

What Are Commodities and Understanding Their Role in the Stock Market

A commodity is a basic good used in commerce that is interchangeable with other goods of the same type.

more

Ax: What It Means, How It Works, and Market Maker Influence

The ax is the market maker who is most central to the price action of a specific security across tradable exchanges.

more

Related Articles

Listed Security: What It Is and How It Works

Types of Stock Exchanges

What Is Forex Trading? A Beginner’s Guide

How Big Is the Derivatives Market?

Overnight Trading: Definition, How It Works, and Example

OTC Pink: Definition, Company Types, Investment Risks

Partner Links

About Us

Terms of Service

Dictionary

Editorial Policy

Advertise

News

Privacy Policy

Contact Us

Careers

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash Meredith publishing family.

Please review our updated Terms of Service.

Just a moment...

a moment...Enable JavaScript and cookies to contiFinancial market - Wikipedia

Financial market - Wikipedia

Jump to content

Main menu

Main menu

move to sidebar

hide

Navigation

Main pageContentsCurrent eventsRandom articleAbout WikipediaContact usDonate

Contribute

HelpLearn to editCommunity portalRecent changesUpload file

Search

Search

Create account

Log in

Personal tools

Create account Log in

Pages for logged out editors learn more

ContributionsTalk

Contents

move to sidebar

hide

(Top)

1Types of financial markets

2Raising capital

Toggle Raising capital subsection

2.1Lenders

2.1.1Individuals and doubles

2.1.2Companies

2.1.3Banks

2.2Borrowers

3Derivative products

4Analysis of financial markets

5Financial market slang

6Functions of financial markets

7Components of financial market

Toggle Components of financial market subsection

7.1Based on market levels

7.2Based on security types

8See also

9References

10Further reading

11External links

Toggle the table of contents

Financial market

52 languages

العربيةঅসমীয়াAzərbaycancaবাংলাБеларускаяБългарскиCatalàČeštinaDanskDeutschEestiEspañolEsperantoEuskaraفارسیFrançaisFurlan한국어Հայերենहिन्दीHrvatskiIdoBahasa IndonesiaItalianoಕನ್ನಡLietuviųLingua Franca NovaМакедонскиMinangkabauNederlands日本語Norsk bokmålOʻzbekcha / ўзбекчаភាសាខ្មែរPolskiPortuguêsRomânăРусскийShqipSimple EnglishSlovenčinaСрпски / srpskiSrpskohrvatski / српскохрватскиSuomiSvenskaไทยТоҷикӣTürkçeУкраїнськаTiếng Việt粵語中文

Edit links

ArticleTalk

English

ReadEditView history

Tools

Tools

move to sidebar

hide

Actions

ReadEditView history

General

What links hereRelated changesUpload fileSpecial pagesPermanent linkPage informationCite this pageGet shortened URLDownload QR codeWikidata item

Print/export

Download as PDFPrintable version

In other projects

Wikimedia CommonsWikiquote

From Wikipedia, the free encyclopedia

Generic term for all markets in which trading takes place with capital

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages)

This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.Find sources: "Financial market" – news · newspapers · books · scholar · JSTOR (February 2022) (Learn how and when to remove this template message)

This article possibly contains original research. Please improve it by verifying the claims made and adding inline citations. Statements consisting only of original research should be removed. (February 2022) (Learn how and when to remove this template message)

(Learn how and when to remove this template message)

Part of a series onFinancial markets

Public market

Exchange · Securities

Bond market

Bond valuation

Corporate bond

Fixed income

Government bond

High-yield debt

Municipal bond

Securitization

Stock market

Common stock

Preferred stock

Registered share

Stock

Stock certificate

Stock exchange

Other markets

Derivatives (Credit derivativeFutures exchangeHybrid security)

Foreign exchange (CurrencyExchange rate)

Commodity

Money

Real estate

Reinsurance

Over-the-counter (off-exchange)

ForwardsOptions

Spot marketSwaps

Trading

Participants

Regulation

Clearing

Related areas

Banks and banking

Finance

corporate

personal

public

vte

Part of a series on financial servicesBanking

Types of banks

Advising

Banq

Bulge bracket

Central

Commercial

Community development

Cooperative

Credit union

Custodian

Depository

Development

Direct

Export credit agency

Investment

Industrial

Merchant

Middle market

Mutual savings

Neobank

Offshore

Participation

Payments

Postal savings

Private

Public

Retail

Savings

Savings and loan

Universal

Wholesale

Bank holding company

Lists of banks

Accounts · Cards

Accounts

Christmas club

Deposit

Money-market

Savings

Time deposit (Bond)

Transaction (checking / current)

Cards

ATM

Credit

Debit

Prepaid

Funds transfer

Cheque

Card

Electronic

Bill payment

Mobile

Wire

RTGS

NS

ACH

Instant payment

Giro

SWIFT

Correspondent account

CLS

CIPS

SPFS

BRICS PAY

Terms

Automated teller machine

Bank regulation

Loan

Mobile banking

Money creation

Bank secrecy

Ethical banking

Fractional-reserve banking

Full-reserve banking

Islamic banking

Private banking

Related topicsFinancial market (participants)

Corporate finance

Personal finance

Public finance

Financial law

Financial regulation

List of banks

Category

Commons

Portalvte

Part of a series onCapitalism

Concepts

Austerity

Business

Business cycle

Businessperson

Capital

Capital accumulation

Capital markets

Company

Corporation

Competitive markets

Economic interventionism

Economic liberalism

Economic surplus

Entrepreneurship

Fictitious capital

Financial market

Free price system

Free market

Goods and services

Investor

Invisible hand

Visible hand

Liberalization

Marginalism

Money

Private property

Privatization

Profit

Rent seeking

Supply and demand

Surplus value

Value

Wage labour

Economic systems

Anglo-Saxon

Authoritarian

Corporate

Dirigist

Free-market

Humanistic

Laissez-faire

Liberal

Libertarian

Market

Mercantilist

Mixed

Monopoly

National

Neoliberal

Nordic

Private

Raw

Regulated market

Regulatory

Rhine

Social

State

State-sponsored

Welfare

Economic theories

American

Austrian

Chartalism

MMT

Chicago

Classical

Institutional

Keynesian

Neo-

New

Post-

Market monetarism

Critique of political economy

Critique of work

Marxist

Monetarist

Neoclassical

New institutional

Supply-side

Origins

Age of Enlightenment

Capitalism and Islam

Commercial Revolution

Feudalism

Industrial Revolution

Mercantilism

Primitive accumulation

Physiocracy

Simple commodity production

Development

Advanced

Consumer

Community

Corporate

Crony

Finance

Global

Illiberal

Late

Marxist

Merchant

Progressive

Rentier

State monopoly

Technological

People

Smith

Mill

Ricardo

Malthus

Say

Marx

Friedman

Hayek

Keynes

Marshall

Pareto

Walras

von Mises

Rand

Rothbard

Schumpeter

Veblen

Weber

Coase

Related topics

Anti-capitalism

Capitalist propaganda

Capitalist realism

Capitalist state

Consumerism

Crisis theory

Criticism of capitalism

Critique of political economy

Critique of work

Cronyism

Culture of capitalism

Evergreening

Exploitation of labour

Globalization

History

History of theory

Market economy

Periodizations of capitalism

Perspectives on capitalism

Post-capitalism

Speculation

Spontaneous order

Venture philanthropy

Wage slavery

Ideologies

Anarcho

Authoritarian

Classical liberalism

Democratic

Dirigisme

Eco

Humanistic

Inclusive

Liberal

Liberalism

Libertarian

Neo

Neoliberalism

Objectivism

Ordoliberalism

Privatism

Right-libertarianism

Third Way

Capitalism portal

Business portalvte

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

The term "market" is sometimes used for what are more strictly exchanges, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange.

Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade on a stock exchange, and people are building electronic systems for these as well, to stock exchanges. There are also global initiatives such as the United Nations Sustainable Development Goal 10 which has a target to improve regulation and monitoring of global financial markets.[1]

Types of financial markets[edit]

Within the financial sector, the term "financial markets" is often used to refer just to the markets that are used to raise finances. For long term finance, they are usually called the capital markets; for short term finance, they are usually called money markets. The money market deals in short-term loans, generally for a period of a year or less. Another common use of the term is as a catchall for all the markets in the financial sector, as per examples in the breakdown below.

Capital markets which consist of:

Stock markets, which provide financing through the issuance of shares or common stock, and enable the subsequent trading thereof.

Bond markets, which provide financing through the issuance of bonds, and enable the subsequent trading thereof.

Commodity markets, The commodity market is a market that trades in the primary economic sector rather than manufactured products, Soft commodities is a term generally referred as to commodities that are grown, rather than mined such as crops (corn, wheat, soybean, fruit and vegetable), livestock, cocoa, coffee and sugar and Hard commodities is a term generally referred as to commodities that are mined such as gold, gemstones and other metals and generally drilled such as oil and gas.

Money markets, which provide short term debt financing and investment.

Derivatives markets, which provide instruments for the management of financial risk.[2]

Futures markets, which provide standardized forward contracts for trading products at some future date; see also forward market.

Foreign exchange markets, which facilitate the trading of foreign exchange.

Cryptocurrency market which facilitate the trading of digital assets and financial technologies.

Spot market

Interbank lending market

The capital markets may also be divided into primary markets and secondary markets. Newly formed (issued) securities are bought or sold in primary markets, such as during initial public offerings. Secondary markets allow investors to buy and sell existing securities. The transactions in primary markets exist between issuers and investors, while secondary market transactions exist among investors.

Liquidity is a crucial aspect of securities that are traded in secondary markets. Liquidity refers to the ease with which a security can be sold without a loss of value. Securities with an active secondary market mean that there are many buyers and sellers at a given point in time. Investors benefit from liquid securities because they can sell their assets whenever they want; an illiquid security may force the seller to get rid of their asset at a large discount.

Raising capital[edit]

Financial markets attract funds from investors and channels them to corporations—they thus allow corporations to finance their operations and achieve growth. Money markets allow firms to borrow funds on a short-term basis, while capital markets allow corporations to gain long-term funding to support expansion (known as maturity transformation).

Without financial markets, borrowers would have difficulty finding lenders themselves. Intermediaries such as banks, Investment Banks, and Boutique Investment Banks can help in this process. Banks take deposits from those who have money to save on the form of savings a/c. They can then lend money from this pool of deposited money to those who seek to borrow. Banks popularly lend money in the form of loans and mortgages.

More complex transactions than a simple bank deposit require markets where lenders and their agents can meet borrowers and their agents, and where existing borrowing or lending commitments can be sold on to other parties. A good example of a financial market is a stock exchange. A company can raise money by selling shares to investors and its existing shares can be bought or sold.

The following table illustrates where financial markets fit in the relationship between lenders and borrowers:

Relationship between lenders and borrowers

Lenders

Financial Intermediaries

Financial Markets

Borrowers

IndividualsCompaniesBanks

BanksInsurance CompaniesPension FundsMutual Funds

InterbankStock ExchangeMoney MarketBond MarketForeign Exchange

IndividualsCompaniesCentral GovernmentMunicipalitiesPublic Corporations

Lenders[edit]

The lender temporarily gives money to somebody else, on the condition of getting back the principal amount together with some interest or profit or charge.

Individuals and doubles[edit]

Many individuals are not aware that they are lenders, but almost everybody does lend money in many ways. A person lends money when he or she:

Puts money in a savings account at a bank

Contributes to a pension plan

Pays premiums to an insurance company

Invests in government bonds

Companies[edit]

Companies tend to be lenders of capital. When companies have surplus cash that is not needed for a short period of time, they may seek to make money from their cash surplus by lending it via short term markets called money markets. Alternatively, such companies may decide to return the cash surplus to their shareholders (e.g. via a share repurchase or dividend payment).

Banks[edit]

Banks can be lenders themselves as they are able to create new debt money in the form of deposits.

Borrowers[edit]

Individuals borrow money via bankers' loans for short term needs or longer term mortgages to help finance a house purchase.

Companies borrow money to aid short term or long term cash flows. They also borrow to fund modernization or future business expansion. It is common for companies to use mixed packages of different types of funding for different purposes – especially where large complex projects such as company management buyouts are concerned.[3]

Governments often find their spending requirements exceed their tax revenues. To make up this difference, they need to borrow. Governments also borrow on behalf of nationalized industries, municipalities, local authorities and other public sector bodies. In the UK, the total borrowing requirement is often referred to as the Public sector net cash requirement (PSNCR).

Governments borrow by issuing bonds. In the UK, the government also borrows from individuals by offering bank accounts and Premium Bonds. Government debt seems to be permanent. Indeed, the debt seemingly expands rather than being paid off. One strategy used by governments to reduce the value of the debt is to influence inflation.

Municipalities and local authorities may borrow in their own name as well as receiving funding from national governments. In the UK, this would cover an authority like Hampshire County Council.

Public Corporations typically include nationalized industries. These may include the postal services, railway companies and utility companies.

Many borrowers have difficulty raising money locally. They need to borrow internationally with the aid of Foreign exchange markets.

Borrowers having similar needs can form into a group of borrowers. They can also take an organizational form like Mutual Funds. They can provide mortgage on weight basis. The main advantage is that this lowers the cost of their borrowings.

Derivative products[edit]

During the 1980s and 1990s, a major growth sector in financial markets was the trade in so called derivatives.

In the financial markets, stock prices, share prices, bond prices, currency rates, interest rates and dividends go up and down, creating risk. Derivative products are financial products that are used to control risk or paradoxically exploit risk.[4] It is also called financial economics.

Derivative products or instruments help the issuers to gain an unusual profit from issuing the instruments. For using the help of these products a contract has to be made. Derivative contracts are mainly four types:[5]

Future

Forward

Option

Swap

Seemingly, the most obvious buyers and sellers of currency are importers and exporters of goods. While this may have been true in the distant past,[when?] when international trade created the demand for currency markets, importers and exporters now represent only 1/32 of foreign exchange dealing, according to the Bank for International Settlements.[6]

The picture of foreign currency transactions today shows:

Banks/Institutions

Speculators

Government spending (for example, military bases abroad)

Importers/Exporters

Tourists

Analysis of financial markets[edit]

See Statistical analysis of financial markets, statistical finance

Much effort has gone into the study of financial markets and how prices vary with time. Charles Dow, one of the founders of Dow Jones & Company and The Wall Street Journal, enunciated a set of ideas on the subject which are now called Dow theory. This is the basis of the so-called technical analysis method of attempting to predict future changes. One of the tenets of "technical analysis" is that market trends give an indication of the future, at least in the short term. The claims of the technical analysts are disputed by many academics, who claim that the evidence points rather to the random walk hypothesis, which states that the next change is not correlated to the last change. The role of human psychology in price variations also plays a significant factor. Large amounts of volatility often indicate the presence of strong emotional factors playing into the price. Fear can cause excessive drops in price and greed can create bubbles. In recent years the rise of algorithmic and high-frequency program trading has seen the adoption of momentum, ultra-short term moving average and other similar strategies which are based on technical as opposed to fundamental or theoretical concepts of market behaviour. For instance, according to a study published by the European Central Bank,[7] high frequency trading has a substantial correlation with news announcements and other relevant public information that are able to create wide price movements (e.g., interest rates decisions, trade of balances etc.)

The scale of changes in price over some unit of time is called the volatility.

It was discovered by Benoit Mandelbrot that changes in prices do not follow a normal distribution, but are rather modeled better by Lévy stable distributions. The scale of change, or volatility, depends on the length of the time unit to a power a bit more than 1/2. Large changes up or down are more likely than what one would calculate using a normal distribution with an estimated standard deviation.

Financial market slang[edit]

Poison pill, when a company issues more shares to prevent being bought out by another company, thereby increasing the number of outstanding shares to be bought by the hostile company making the bid to establish majority.

Bips, meaning "bps" or basis points. A basis point is a financial unit of measurement used to describe the magnitude of percent change in a variable. One basis point is the equivalent of one hundredth of a percent. For example, if a stock price were to rise 100bit/s, it means it would increase 1%.

Quant, a quantitative analyst with advanced training in mathematics and statistical methods.

Rocket scientist, a financial consultant at the zenith of mathematical and computer programming skill. They are able to invent derivatives of high complexity and construct sophisticated pricing models. They generally handle the most advanced computing techniques adopted by the financial markets since the early 1980s. Typically, they are physicists and engineers by training.

IPO, stands for initial public offering, which is the process a new private company goes through to "go public" or become a publicly traded company on some index.

White Knight, a friendly party in a takeover bid. Used to describe a party that buys the shares of one organization to help prevent against a hostile takeover of that organization by another party.

Round-tripping

Smurfing, a deliberate structuring of payments or transactions to conceal it from regulators or other parties, a type of money laundering that is often illegal.

Bid–ask spread, the difference between the highest bid and the lowest offer.

Pip, smallest price move that a given exchange rate makes based on market convention.[8]

Pegging, when a country wants to obtain price stability, it can use pegging to fix their exchange rate relative to another currency.[9]

Bearish, this phrase is used to refer to the fact that the market has a downward trend.

Bullish, this term is used to refer to the fact that the market has an upward trend.

Functions of financial markets[edit]

Intermediary functions: The intermediary functions of financial markets include the following:

Transfer of resources: Financial markets facilitate the transfer of real economic resources from lenders to ultimate borrowers.

Enhancing income: Financial markets allow lenders to earn interest or dividend on their surplus invisible funds, thus contributing to the enhancement of the individual and the national income.

Productive usage: Financial markets allow for the productive use of the funds borrowed. The enhancing the income and the gross national production.

Capital formation: Financial markets provide a channel through which new savings flow to aid capital formation of a country.

Price determination: Financial markets allow for the determination of price of the traded financial assets through the interaction of buyers and sellers. They provide a sign for the allocation of funds in the economy based on the demand and to the supply through the mechanism called price discovery process.

Sale mechanism: Financial markets provide a mechanism for selling of a financial asset by an investor so as to offer the benefit of marketability and liquidity of such assets.

Information: The activities of the participants in the financial market result in the generation and the consequent dissemination of information to the various segments of the market. So as to reduce the cost of transaction of financial assets.

Financial Functions

Providing the borrower with funds so as to enable them to carry out their investment plans.

Providing the lenders with earning assets so as to enable them to earn wealth by deploying the assets in production debentures.

Providing liquidity in the market so as to facilitate trading of funds.

Providing liquidity to commercial bank

Facilitating credit creation

Promoting savings

Promoting investment

Facilitating balanced economic growth

Improving trading floors

Components of financial market[edit]

Based on market levels[edit]

Primary market: A primary market is a market for new issues or new financial claims. Therefore, it is also called new issue market. The primary market deals with those securities which are issued to the public for the first time.

Secondary market: A market for secondary sale of securities. In other words, securities which have already passed through the new issue market are traded in this market. Generally, such securities are quoted in the stock exchange and it provides a continuous and regular market for buying and selling of securities.

Simply put, primary market is the market where the newly started company issued shares to the public for the first time through IPO (initial public offering). Secondary market is the market where the second hand securities are sold (security Commodity Markets).

Based on security types[edit]

Money market: Money market is a market for dealing with the financial assets and securities which have a maturity period of up to one year. In other words, it is a market for purely short-term funds.

Capital market: A capital market is a market for financial assets that have a long or indefinite maturity. Generally, it deals with long-term securities that have a maturity period of above one year. The capital market may be further divided into (a) industrial securities market (b) Govt. securities market and (c) long-term loans market.

Equity markets: A market where ownership of securities are issued and subscribed is known as equity market. An example of a secondary equity market for shares is the New York (NYSE) stock exchange.

Debt market: The market where funds are borrowed and lent is known as debt market. Arrangements are made in such a way that the borrowers agree to pay the lender the original amount of the loan plus some specified amount of interest.

Derivative markets: A market where financial instruments are derived and traded based on an underlying asset such as commodities or stocks.

Financial service market: A market that comprises participants such as commercial banks that provide various financial services like ATM. Credit cards. Credit rating, stock broking etc. is known as financial service market. Individuals and firms use financial services markets, to purchase services that enhance the workings of debt and equity markets.

Depository markets: A depository market consists of depository institutions (such as banks) that accept deposits from individuals and firms and uses these funds to participate in the debt market, by giving loans or purchasing other debt instruments such as treasury bills.

Non-depository market: Non-depository market carry out various functions in financial markets ranging from financial intermediary to selling, insurance etc. The various constituencies in non-depositary markets are mutual funds, insurance companies, pension funds, brokerage firms etc.

Relation between Bonds and Commodity Prices: With the increase in commodity prices, the cost of goods for companies increases. This increase in commodity prices level causes a rise in inflation.

Relation between Commodities and Equities: Due to the production cost remaining same, and revenues rising (due to high commodity prices), the operating profit (revenue minus cost) increases, which in turn drives up equity prices.

See also[edit]

Common ordinary equity

Cooperative banking

Finance capitalism

Financial instrument

Financial market efficiency

Financial market theory of development

Financial services

Investment theory

Liquidity

Market profile

Mathematical finance

Quantitative behavioral finance

Stock investor

References[edit]

^ "Goal 10 targets". UNDP. Archived from the original on 2020-11-27. Retrieved 2020-09-23.

^ "Understanding Derivatives: Markets and Infrastructure - Federal Reserve Bank of Chicago". chicagofed.org. Retrieved 2017-12-12.

^ The Business Finance Market: A Survey ISR/Google Books, 2013.

^ Robert E. Wright and Vincenzo Quadrini. Money and Banking: "Chapter 2, Section 4: Financial Markets." pp. 3 [1] Accessed June 20, 2012

^ Khader Shaik (23 September 2014). Managing Derivatives Contracts: A Guide to Derivatives Market Structure, Contract Life Cycle, Operations, and Systems. Apress. p. 23. ISBN 978-1-4302-6275-6.

^ Steven Valdez, An Introduction To Global Financial Markets

^ "High Frequency Trading and Price Discovery, Working Paper Series NO 1602 / november 2013" (PDF). Archived (PDF) from the original on 2022-10-09. Retrieved 7 December 2021.

^ Momoh, Osi (2003-11-25). "Pip". Investopedia. Retrieved 2017-12-12.

^ Law, Johnathan (2016). "Pegging". A dictionary of business and management. Oxford University Press. ISBN 9780199684984. OCLC 950964886.

Further reading[edit]

Graham, Benjamin; Jason Zweig (2003-07-08) [1949]. The Intelligent Investor. Warren E. Buffett (collaborator) (2003 ed.). HarperCollins. front cover. ISBN 0-06-055566-1.

Graham, B.; Dodd, D.L.F. (1934). Security Analysis: The Classic 1934 Edition. McGraw-Hill Education. ISBN 978-0-070-24496-2. LCCN 34023635.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!, by Robert Kiyosaki and Sharon Lechter. Warner Business Books, 2000. ISBN 0-446-67745-0

Clason, George (2015). The Richest Man in Babylon: Original 1926 Edition. CreateSpace Independent Publishing Platform. ISBN 978-1-508-52435-9.

Bogle, John Bogle (2007). The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns. John Wiley and Sons. pp. 216. ISBN 9780470102107.

Buffett, W.; Cunningham, L.A. (2009). The Essays of Warren Buffett: Lessons for Investors and Managers. John Wiley & Sons (Asia) Pte Limited. ISBN 978-0-470-82441-2.

Stanley, Thomas J.; Danko, W.D. (1998). The Millionaire Next Door. Gallery Books. ISBN 978-0-671-01520-6. LCCN 98046515.

Soros, George (1988). The Alchemy of Finance: Reading the Mind of the Market. A Touchstone book. Simon & Schuster. ISBN 978-0-671-66238-7. LCCN 87004745.

Fisher, Philip Arthur (1996). Common Stocks and Uncommon Profits and Other Writings. Wiley Investment Classics. Wiley. ISBN 978-0-471-11927-2. LCCN 95051449.

Elton, E.J.; Gruber, M.J.; Brown, S.J.; Goetzmann, W.N. (2006). Modern Portfolio Theory and Investment Analysis. Wiley. ISBN 978-0-470-05082-8. LCCN 2007276500.

Fama, Eugene (1976). Foundations Of Finance. Basic Books. ISBN 978-0-465-02499-5. LCCN 75036771.

Merton, Robert C. (1992). Continuous-Time Finance. Macroeconomics and Finance Series. Wiley. ISBN 978-0-631-18508-6. LCCN gb92034883.

Pilbeam, K. (2010). Finance and Financial Markets. Macmillan Education. ISBN 978-0-230-23321-8. LCCN 2010455281.

Mccarty, Nolan. "Trends in Financial Market Regulation." After the Crash: Financial Crises and Regulatory Responses, edited by Sharyn O’Halloran and Thomas Groll, Columbia University Press, 2019, pp. 121–24, JSTOR 10.7312/ohal19284.10.

GROLL, THOMAS, et al. "TRENDS AND DELEGATION IN U. S. FINANCIAL MARKET REGULATION." After the Crash: Financial Crises and Regulatory Responses, edited by Thomas Groll and Sharyn O’Halloran, Columbia University Press, 2019, pp. 57–81, JSTOR 10.7312/ohal19284.7.

Polillo, Simone. "COLLABORATIONS AND MARKET EFFICIENCY: The Network of Financial Economics." The Ascent of Market Efficiency: Finance That Cannot Be Proven, Cornell University Press, 2020, pp. 60–89, JSTOR 10.7591/j.ctvqc6k17.5.

Abolafia, Mitchel Y. "A Learning Moment?: January 2008." Stewards of the Market: How the Federal Reserve Made Sense of the Financial Crisis, Harvard University Press, 2020, pp. 49–70, doi:10.2307/j.ctvx8b796.6.

MacKenzie, Donald. "Dealers, Clients, and the Politics of Market Structure." Trading at the Speed of Light: How Ultrafast Algorithms Are Transforming Financial Markets, Princeton University Press, 2021, pp. 105–34, doi:10.2307/j.ctv191kx1k.8.

Polillo, Simone. "HOW FINANCIAL ECONOMICS GOT ITS SCIENCE." The Ascent of Market Efficiency: Finance That Cannot Be Proven, Cornell University Press, 2020, pp. 119–42, JSTOR 10.7591/j.ctvqc6k17.7.

Fenton-O'Creevy, M.; Nicholson, N.; Soane, E.; Willman, P. (2004). Traders: Risks, Decisions, and Management in Financial Markets. Oxford University Press. ISBN 978-0-191-51500-2. LCCN 2005295074.

Baker, H.K.; Filbeck, G.; Ricciardi, V. (2017). Financial Behavior: Players, Services, Products, and Markets. Financial Markets and Investments. Oxford University Press. ISBN 978-0-190-27001-8.

Keim, D.B.; Ziemba, W.T.; Moffatt, H.K. (2000). Security Market Imperfections in Worldwide Equity Markets. Publications of the Newton Institute. Cambridge University Press. ISBN 978-0-521-57138-8. LCCN 00698005.

Williams, John C. "The Rediscovery of Financial Market Imperfections." Toward a Just Society: Joseph Stiglitz and Twenty-First Century Economics, edited by Martin Guzman, Columbia University Press, 2018, pp. 201–06, JSTOR 10.7312/guzm18672.14.

QUIGGIN, JOHN. "Market Failure: Information, Uncertainty, and Financial Markets." Economics in Two Lessons: Why Markets Work So Well, and Why They Can Fail So Badly, Princeton University Press, 2019, pp. 214–36, doi:10.2307/j.ctvc77fb7.18.

BAKLANOVA, VIKTORIA, and JOSEPH TANEGA. "MONEY MARKET FUNDS AFTER THE ONSET OF THE CRISIS." After the Crash: Financial Crises and Regulatory Responses, edited by Sharyn O’Halloran and Thomas Groll, Columbia University Press, 2019, pp. 341–59, JSTOR 10.7312/ohal19284.25.

CEBALLOS, FRANCISCO, et al. "Financial Globalization in Emerging Countries: Diversification versus Offshoring." New Paradigms for Financial Regulation: Emerging Market Perspectives, edited by MASAHIRO KAWAI and ESWAR S. PRASAD, Brookings Institution Press, 2013, pp. 110–36, JSTOR 10.7864/j.ctt1261n4.8.

LiPuma, Edward. "Social Theory and the Market for the Production of Financial Knowledge." The Social Life of Financial Derivatives: Markets, Risk, and Time, Duke University Press, 2017, pp. 81–115, JSTOR j.ctv11cw1p0.6.

Scott, Hal S. "Liability Connectedness: Money Market Funds and Tri-Party Repo Market." Connectedness and Contagion: Protecting the Financial System from Panics, The MIT Press, 2016, pp. 53–58, JSTOR j.ctt1c2crp5.9.

Sornette, Didier. "MODELING FINANCIAL BUBBLES AND MARKET CRASHES." Why Stock Markets Crash: Critical Events in Complex Financial Systems, REV-Revised, Princeton University Press, 2017, pp. 134–70, JSTOR j.ctt1h1htkg.9.

Morse, Julia C. "A PRIMER ON INTERNATIONAL FINANCIAL STANDARDS ON ILLICIT FINANCING." The Bankers' Blacklist: Unofficial Market Enforcement and the Global Fight against Illicit Financing, Cornell University Press, 2021, pp. 19–29, JSTOR 10.7591/j.ctv1hw3x0d.7.

Obstfeld, M.; Taylor, A.M. (2005). Global Capital Markets: Integration, Crisis, and Growth. Japan-US Center UFJ Bank Monographs on International Financial Markets. Cambridge University Press. ISBN 978-0-521-67179-8. LCCN 2004051477.

Bebczuk, R.N. (2003). Asymmetric Information in Financial Markets: Introduction and Applications. Cambridge University Press. ISBN 978-0-521-79732-0. LCCN 2002045514.

Avgouleas, E. (2012). Governance of Global Financial Markets: The Law, the Economics, the Politics. Cambridge University Press. ISBN 978-0-521-76266-3. LCCN 2012406001.

Houthakker, H.S.; Williamson, P.J. (1996). The Economics of Financial Markets. Oxford University Press. ISBN 978-0-199-31499-7.

Spencer, P.D. (2000). The Structure and Regulation of Financial Markets. Oxford University Press. ISBN 978-0-191-58686-6. LCCN 2001270248.

Atack, J.; Neal, L. (2009). The Origins and Development of Financial Markets and Institutions: From the Seventeenth Century to the Present. Cambridge University Press. ISBN 978-1-139-47704-8.

Ott, J.C. (2011). When Wall Street Met Main Street: The Quest for an Investors' Democracy. Harvard University Press. ISBN 978-0-674-06121-7. LCCN 2010047293.

Prasad, E.S. (2021). The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance. Harvard University Press. ISBN 978-0-674-25844-0. LCCN 2021008025.

Fligstein, N. (2021). The Banks Did It: An Anatomy of the Financial Crisis. Harvard University Press. ISBN 978-0-674-25901-0.

External links[edit]

Wikimedia Commons has media related to Financial markets.

Financial Markets with Yale Professor Robert Shiller (Archived 2010-11-03 at the Wayback Machine)

vteFinancial marketsTypes of markets

Primary market

Secondary market

Third market

Fourth market

Types of stocks

Common stock

Golden share

Preferred stock

Restricted stock

Tracking stock

Share capital

Authorised capital

Issued shares

Shares outstanding

Treasury stock

Participants

Broker

Floor broker

Inter-dealer broker

Broker-dealer

Market maker

Trader

Floor trader

Proprietary trader

Quantitative analyst

Investor

Hedger

Speculator

Arbitrager

Scalper

Regulator

Trading venues

Exchange

List of stock exchanges

Trading hours

Over-the-counter (off-exchange)

Alternative Trading System (ATS)

Multilateral trading facility (MTF)

Electronic communication network (ECN)

Direct market access (DMA)

Straight-through processing (STP)

Dark pool (private exchange)

Crossing network

Liquidity aggregator

Stock valuation

Alpha

Arbitrage pricing theory (APT)

Beta

Buffett indicator (Cap-to-GDP)

Book value (BV)

Capital asset pricing model (CAPM)

Capital market line (CML)

Dividend discount model (DDM)

Dividend yield

Earnings yield

EV/EBITDA

Fed model

Net asset value (NAV)

Security characteristic line

Security market line (SML)

T-model

Trading theories and strategies

Algorithmic trading

Buy and hold

Contrarian investing

Dollar cost averaging

Efficient-market hypothesis (EMH)

Fundamental analysis

Growth stock

Market timing

Modern portfolio theory (MPT)

Momentum investing

Mosaic theory

Pairs trade

Post-modern portfolio theory (PMPT)

Random walk hypothesis (RMH)

Sector rotation

Style investing

Swing trading

Technical analysis

Trend following

Value averaging

Value investing

Related terms

Bid–ask spread

Block trade

Cross listing

Dividend

Dual-listed company

DuPont analysis

Efficient frontier

Financial law

Flight-to-quality

Government bond

Greenspan put

Haircut

Initial public offering (IPO)

Long

Margin

Market anomaly

Market capitalization

Market depth

Market manipulation

Market trend

Mean reversion

Momentum

Open outcry

Order book

Position

Public float

Public offering

Rally

Returns-based style analysis

Reverse stock split

Share repurchase

Short selling

Slippage

Speculation

Stock dilution

Stock exchange

Stock market index

Stock split

Trade

Uptick rule

Volatility

Voting interest

Yield

vteGeneral areas of finance

Capital management

Computational finance

Experimental finance

Financial economics

Financial engineering

Financial institutions

Financial management

Financial markets

Financial technology (Fintech)

International finance

Investment management

Mathematical finance

Personal finance

Public finance

Quantitative behavioral finance

Quantum finance

Statistical finance

Authority control databases: National

Japan

Czech Republic

Retrieved from "https://en.wikipedia.org/w/index.php?title=Financial_market&oldid=1212701362"

Categories: Financial marketsPrivate sectorHidden categories: Articles with short descriptionShort description matches WikidataArticles needing additional references from February 2022All articles needing additional referencesArticles that may contain original research from February 2022All articles that may contain original researchArticles with multiple maintenance issuesAll articles with vague or ambiguous timeVague or ambiguous time from February 2011Commons category link is on WikidataWebarchive template wayback linksArticles with NDL identifiersArticles with NKC identifiers

This page was last edited on 9 March 2024, at 04:50 (UTC).

Text is available under the Creative Commons Attribution-ShareAlike License 4.0;

additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

Privacy policy

About Wikipedia

Disclaimers

Contact Wikipedia

Code of Conduct

Developers

Statistics

Cookie statement

Mobile view

Toggle limited content width

Financial Markets - Overview, Types, and Functions

Financial Markets - Overview, Types, and Functions

Corporate Finance Institute

Menu

All Courses

Certification ProgramsIndustry designations for developing comprehensive, domain-specific skills.

Explore Certifications

FMVA®Financial Modeling & Valuation Analyst

CBCA®Commercial Banking & Credit Analyst

CMSA®Capital Markets & Securities Analyst

BIDA®Business Intelligence & Data Analyst

FPWM™Financial Planning & Wealth Management

FTIP™FinTech Industry Professional

SpecializationsExpert-curated programs in targeted skill areas.

Explore Specializations

Environmental, Social, & Governance(ESG)

Leadership Effectiveness

Data Analysis in Excel

Business Intelligence

Data Science

Macabacus

Real Estate Finance

Crypto and Digital Assets

BE Bundle

Learning PathsTailored courses for specific roles. Exclusively for CFI for Teams customers.

Investment Banking

Advisory

DCM

ECM

Commercial Banking

Credit Analyst

Real Estate Lender

Relationship Manager

Global Markets – Sales and Trading

Equity Sales-Trader

Fixed Income Credit Sales

FX Trader

Equity Researcher

Buy-Side Institutions

Derivatives Risk Manager

Equity Execution Trader

Fixed Income Researcher

Hedge Fund

FP&A

Business Intelligence

Data Science

Wealth Management

Financial Planner

Investment Advisor

Explore Learning Paths

Popular TopicsExplore courses and resources in high-demand areas.

Explore Topics

Cryptocurrency

Excel

Accounting

Commercial Real Estate

ESG

Wealth Management

Foreign Exchange

Management Skills

Machine Learning

Financial Modeling

FP&A

Business Intelligence

Explore Courses

CFI For Teams

Overview

Overview

Pricing

Why CFI Certifications?

Get Started

CFI Help

How CFI Can Help

New Hire Training

Hybrid Team Training

Upskilling and Reskilling

Retaining Talent

Corporate Solutions

Finance Teams

Financial Services

Professional Services

Pricing

For Individuals

For Teams

Resources

Financial Ratios Definitive Guide

A free best practices guide for essential ratios in comprehensive financial analysis and business decision-making.

Download Now

Browse All Resources

eLearning

Career

Team Development

Management

Excel

Accounting

Valuation

Economics

ESG

Capital Markets

Data Science

Risk Management

My Account

My Courses

My Profile

Sign Out

My Dashboard

Log In

Start Free

Training Library

Certifications

Financial Modeling & Valuation (FMVA®)

Certified Banking & Credit Analyst (CBCA®)

Capital Markets & Securities Analyst (CMSA®)

Business Intelligence & Data Analyst (BIDA®)

Financial Planning & Wealth Management (FPWM™)

FinTech Industry Professional (FTIP™)

Specializations

Commercial Real Estate Finance Specialization

Environmental, Social & Governance Specialization

Data Analysis in Excel Specialization

Cryptocurrencies and Digital Assets Specialization

Business Intelligence Analyst Specialization

Leadership Effectiveness Certificate Program

Data Science Analyst

Macabacus Specialist

Business Essentials Bundle (BEB)

CFI For Teams

Overview

How CFI Can Help

New Hire Training

Hybrid Team Training

Upskilling and Reskilling

Retaining Talent

Corporate Solutions

Finance Teams

Financial Services

Pricing

Pricing

Resources

My Account

My Courses

My Profile

Sign Out

Log In

Start

Free

Home › Resources › Career Map › Sell-Side Banks › Capital Markets › Financial Markets

Table of contents

What are Financial Markets?

Types of Financial Markets

Functions of the Markets

Importance of Financial Markets

Additional Resources

Financial Markets

A marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

Start Free

Written by

CFI Team

What are Financial Markets?

Financial markets, from the name itself, are a type of marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives. Often, they are called by different names, including “Wall Street” and “capital market,” but all of them still mean one and the same thing. Simply put, businesses and investors can go to financial markets to raise money to grow their business and to make more money, respectively.

To state it more clearly, let us imagine a bank where an individual maintains a savings account. The bank can use their money and the money of other depositors to loan to other individuals and organizations and charge an interest fee.

The depositors themselves also earn and see their money grow through the interest that is paid to it. Therefore, the bank serves as a financial market that benefits both the depositors and the debtors.

Types of Financial Markets

There are so many financial markets, and every country is home to at least one, although they vary in size. Some are small while some others are internationally known, such as the New York Stock Exchange (NYSE) that trades trillions of dollars on a daily basis. Here are some types of financial markets.

1. Stock market

The stock market trades shares of ownership of public companies. Each share comes with a price, and investors make money with the stocks when they perform well in the market. It is easy to buy stocks. The real challenge is in choosing the right stocks that will earn money for the investor.

There are various indices that investors can use to monitor how the stock market is doing, such as the Dow Jones Industrial Average (DJIA) and the S&P 500. When stocks are bought at a cheaper price and are sold at a higher price, the investor earns from the sale.

2. Bond market

The bond market offers opportunities for companies and the government to secure money to finance a project or investment. In a bond market, investors buy bonds from a company, and the company returns the amount of the bonds within an agreed period, plus interest.

3. Commodities market

The commodities market is where traders and investors buy and sell natural resources or commodities such as corn, oil, meat, and gold. A specific market is created for such resources because their price is unpredictable. There is a commodities futures market wherein the price of items that are to be delivered at a given future time is already identified and sealed today.

4. Derivatives market

Such a market involves derivatives or contracts whose value is based on the market value of the asset being traded. The futures mentioned above in the commodities market is an example of a derivative.

Functions of the Markets

The role of financial markets in the success and strength of an economy cannot be underestimated. Here are four important functions of financial markets:

1. Puts savings into more productive use

As mentioned in the example above, a savings account that has money in it should not just let that money sit in the vault. Thus, financial markets like banks open it up to individuals and companies that need a home loan, student loan, or business loan.

2. Determines the price of securities

Investors aim to make profits from their securities. However, unlike goods and services whose price is determined by the law of supply and demand, prices of securities are determined by financial markets.

3. Makes financial assets liquid

Buyers and sellers can decide to trade their securities anytime. They can use financial markets to sell their securities or make investments as they desire.

4. Lowers the cost of transactions

In financial markets, various types of information regarding securities can be acquired without the need to spend.

Importance of Financial Markets

There are many things that financial markets make possible, including the following:

Financial markets provide a place where participants like investors and debtors, regardless of their size, will receive fair and proper treatment.

They provide individuals, companies, and government organizations with access to capital.

Financial markets help lower the unemployment rate because of the many job opportunities it offers

Additional Resources

Thank you for reading CFI’s guide on Financial Markets. To keep learning and advancing your career, the following resources will be helpful:

London International Financial Futures & Options Exchange

New York Mercantile Exchange (NYMEX)

Stock Market

Types of Markets – Dealers, Brokers, Exchanges

See all wealth management resources

Share this article

Get Certified for Capital Markets (CMSA®)

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

Learn More

CFI logo

Company

About CFI

Meet Our Team

Careers at CFI

Editorial Standards

CPE Credits

Learner Reviews

Partnerships

Affiliates

Higher Education

Certifications

FMVA®

CBCA®

CMSA®

BIDA®

FPWM™

ESG

Leadership

Excel

CFI For Teams

Financial Services

Corporate Finance

Professional Services

Support

Help | FAQ

Financial Aid

Legal

Community

Member Community

What’s New

NetLearnings

Podcast

Resources

Logo

Trustpilot

Logo

Logo

Logo

Trustpilot

Logo

© 2015 to 2024 CFI Education Inc.

Follow us on LinkedIn

Follow us on Instagram

Follow us on Facebook

Follow us on YouTube

Privacy Policy

Terms of Use

Terms of Service

Legal

Corporate Finance Institute

Back to Website

0 search results for ‘’

People also search for:

excel

Free

free courses

accounting

ESG

Balance sheet

wacc

Explore Our Certifications

Financial Modeling & Valuation Analyst (FMVA)®

Commercial Banking & Credit Analyst (CBCA)®

Capital Markets & Securities Analyst (CMSA)®

Certified Business Intelligence & Data Analyst (BIDA)®

Financial Planning & Wealth Management (FPWM)™

FinTech Industry Professional (FTIP)™

Resources

Excel Shortcuts PC Mac

List of Excel Shortcuts

Excel shortcuts[citation...

Financial Modeling Guidelines

CFI’s free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and...

SQL Data Types

What are SQL Data Types?

The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information...

Structured Query Language (SQL)

What is Structured Query Language (SQL)?

Structured Query Language (known as SQL) is a programming language used to interact with a database....

See All Resources

See All

Popular Courses

Free!

BIDA® Prep Course

3.5h

Excel Fundamentals - Formulas for Finance

FMVA® Required

6.5h

3-Statement Modeling

Free!

FMVA® Required

6h

Introduction to Business Valuation

FMVA® Required

2.5h

Scenario & Sensitivity Analysis in Excel

BIDA® Required

6h

Dashboards & Data Visualization

FMVA® Electives

15h

Leveraged Buyout (LBO) Modeling

See All Courses

See All

Recent Searches

Suggestions

Free Courses

Excel Courses

Financial Modeling & Valuation Analyst (FMVA)®

×

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Create a Free Account

Already have an account? Log in

×

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Discover Paid Memberships

Already have a Self-Study or Full-Immersion membership? Log in

×

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Discover Full-Immersion Membership

Already have a Full-Immersion membership? Log in

Financial Market: Meaning, Definition, Types, Functions, Example

Financial Market: Meaning, Definition, Types, Functions, Example